Will Your Nest Egg Withstand Inflation and Market Volatility?

It’s no secret that inflation is on the rise, impacting millions of Americans. Mix that in with on-again off-again tariffs, and it’s a good time to assess if your accumulated wealth is being managed in a way that will outlast inflation and a volatile market. It’s important to note that a financial plan is never supposed to be stagnant, it’s supposed to change as your situation and world economic conditions shift. But anxiety around the market and inflation is still very real, so how can we get ahead of it?

Remember, Nothing Stays the Same Forever

In early April, we saw massive swings in market sentiment as Trump teetered back and forth about tariffs. While we all hope to avoid increased inflation or, worse, a recession, we have to be strategic in how we face challenges in the market. This is a good time to remember that the markets are similar to us in the sense that nothing stays the same. The challenges you faced in your early 20s are not the same ones you have today. How long they took to resolve may vary, but they never stayed forever. Imagine if you followed your initial knee-jerk, emotional reaction to those challenges you faced when you were younger. Making decisions based on emotion, especially fear, rarely helps you reach your goals, and frankly, they can sabotage you from ever getting close to them.

So, going back to our current market situation, what can investors do right now? Well, depending on their specific situation, the answers vary.

If You’re Young, or You Have More Than 10-15 Years to Retirement

If you have a long time-horizon to retirement, it may be best to wait it out, and continue to invest. A financial principle called “dollar cost averaging” might apply to you, as you may come out ahead in the long-term by continuing to “buy” during both market lows as well as highs through the years.

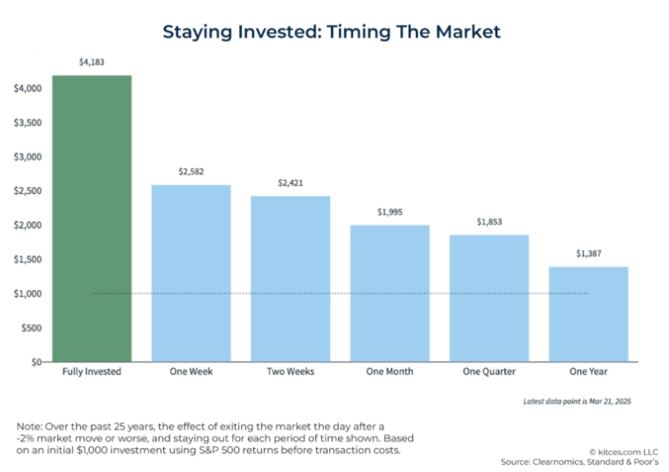

See the chart below:

This chart shows that those who exit the market the day after every -2% market move or worse over a 25-year time period usually underperform those who remain fully invested. When you leave the market, you don’t just avoid future bad days, you also miss out on the future good days. Ultimately, missing even just a few of the market's best days, or getting back into the market only after the market is already up, can significantly impact long-term returns. Because, remember, just like in life, nothing stays bad forever; good days will come again. The market is no different.

If You’re Older and Getting Close to Retirement

As you get closer to retirement, continuing to stay in volatile stock markets exposing all of your savings to stock market risk probably doesn’t make sense due to a financial principle called “sequence of returns risk.” With all things being equal, someone who retires during a down market can see their retirement savings drop precipitously for the long-term if they start withdrawing funds, versus someone who retires when markets are going up. This is a very important consideration at the very beginning of your retirement when your account balance is at its highest, but unfortunately, no one has a crystal ball. You probably need to rebalance in order to reduce portfolio risk.

Consider Rebalancing Your Portfolio

First, you’ll want to ensure your portfolio’s ratios of international stocks, large-cap and mid-cap, bonds, cash, and fixed options make sense in the current economic environment. Different asset classes have varying cycles of performance, which can help address inflation headwinds. But keep in mind that there are other ways you can de-risk your portfolio, especially as you head toward retirement.

Sometimes considered a separate asset class, in the last few years, annuity sales have risen as 10,000 people per day turn 65 in America. An annuity is a contract between an individual and an insurance company designed to provide a monthly stipend during retirement. Some annuities even provide retirement income that won’t run out no matter how long you live, guaranteed by the financial strength of the insurance company providing the annuity policy. There are many different types of annuities, contracts can be complex, they are illiquid, and there should always be other cash and investments to balance out your retirement plan even if you have an annuity or annuities. Furthermore, annuities are not right for everyone. It’s advisable to work with a financial professional to look at your overall plan, compare your options, and closely examine contract terms.

Other Personal Actions You Can Take To Manage Inflation

Additionally, to help make your dollar in your day-to-day life last longer, do a thorough review of your spending. This is the time to evaluate essential vs. discretionary expenses, for example, a mortgage versus a new car. This gives you a chance to identify unnecessary spending that you can cut back on. Most people are shocked by how much they were spending on things they did not need!

Some common expenses that are good to look at critically during this audit:

· Takeout & Dining – Frequent restaurant visits, coffee runs, food delivery, and takeout orders.

· Subscription Services – Streaming (Netflix, Hulu, HBO Max), music, gaming, news, and fitness apps.

· Retail & Impulse Shopping – Clothing, accessories, home décor, and non-essential purchases.

· Unused Memberships – Gym memberships, fitness classes, warehouse clubs, and subscription boxes.

· Premium TV Packages – Expensive cable or satellite plans with unnecessary channels.

· Frequent Travel – Weekend getaways, flights, hotels, and vacation entertainment costs.

· Luxury & Self-Care – Salon visits, spa treatments, manicures, and pedicures.

· High-End Brands – Designer clothing, accessories, and premium tech gadgets.

· Hobby Expenses – Collectibles, gaming, crafting supplies, and other leisure-related purchases.

· Tech Upgrades – Constantly replacing smartphones, tablets, and accessories with the latest models.

· Costly Entertainment – Concerts, sporting events, amusement parks, and other high-ticket experiences.

Also, see if you can negotiate on those essential bills. While many essential bills are a fixed amount, some can be adjusted or reduced. You may be able to lower expenses for service contracts like internet or insurance. You may also be able to lower your credit card rates. While there’s no guarantee, it never hurts to call a service representative and see if you can get a better price for the things you have to pay for.

While dealing with inflation and market volatility is no one's ideal situation, it doesn't have to be a nightmare either. Do you need help getting your accumulated assets inflation-ready and putting a plan together to hedge against market risk? Call us today! You can reach Five Pathways Financial by setting up an appointment here or by calling (480) 933-8300.

Sources

https://www.aarpinternational.org/initiatives/aging-readiness-competitiveness-arc/united-states

At your fingertips, anytime, anywhere.

Wherever the road takes you, we’re right by your side. Think of us as retirement GPS without the annoying robot voice.

Here to help you make sense of it all.

Don’t just retire. Retire with a purpose. Our Mission is to make your retirement better, plain and simple. We’re real people with families and goals, just like you. So we understand how personal retirement is. We’ll be with you every step of the way, making sure you’re always on the right path.